After a year of tapering, the Fedâs balance sheet finally captured the marketâs attention during the last three months of 2018.

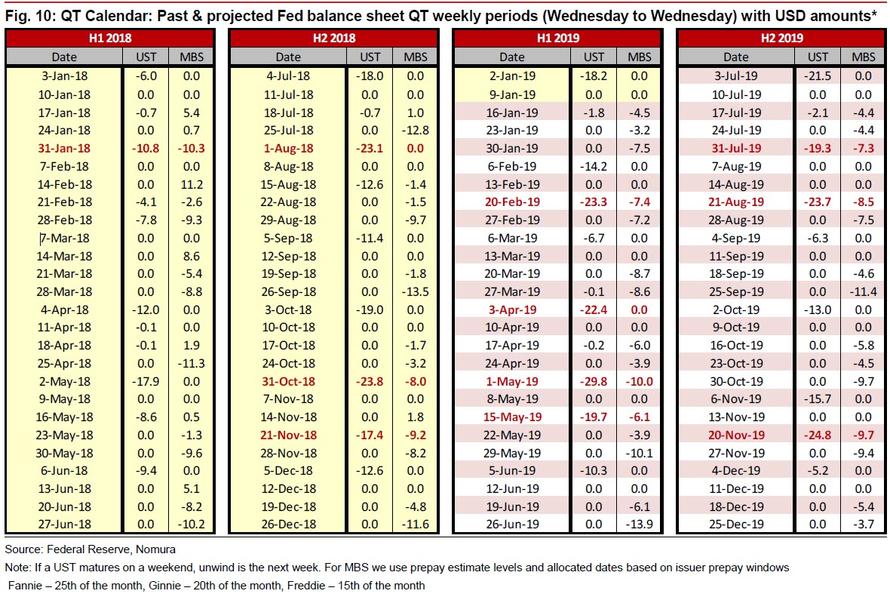

By the start of the fourth quarter, the Fed had finished raising the caps on monthly roll-off of its balance sheet to the full $50bn per month (peaking at $30bn USTs, $20bn MBS, although on many months the B/S does not actually shrink by this full amount which depends on the redemption schedule) and by end-Q4 markets also experienced some of the largest volatility and drawdowns in nearly a decade.

As Nomura's George Concalves writes in a Friday letter, whether it was a coincidence or not, broader markets questioned the Fedâs original view that B/S roll-off was going to be like âwatching paint dry.â Indeed, recent Fedspeak has shifted to being more open-minded, with Fed policy makers suggesting that they are prepared to be âflexibleâ in implementing their balance sheet policy.

The reason for that is that as both the market and the Fed (and especially Chicago Fed president Charles Evans) were violently reminded, just as QE added liquidity and boosted all asset prices, so QT is draining liquidity from the system. Worse, as Marko Kolanovic wrote in his latest report from Jan 16, given the recent collapse in liquidity and the toxic feedback loop of flows- liquidity-volatility which we discussed last week, "investors are very attentive to monetary policy measures that may affect liquidity."

And since the most closely watched metric of systemic liquidity is once again the pace of the Fedâs balance sheet change, and specifically, reduction, Kolanovic notes the recent example of a sharply negative market reaction to the comment that balance sheet reduction (Quantitative Tightening or QT) will be on autopilot (and positive reaction when this statement was later modified). Additionally, even casual remarks on the balance sheet has dramatic and "significantly negative intraday impacts on markets" (such as Powell's recent remarks that the balance sheet should be "substantially smaller").

But why, Kolanovic asks rhetorically, is there such a focus on the Fedâs balance sheet from investors?

The answer is obvious: by now only clueless hacks will deny that adding liquidity in the form of QE was the single, most important factor driving asset classes higher over the past decade. According to JPMorgan, the impact of QE was ~20% of equity prices (see the bank's report here).

Yet while qualitatively the answer is simple, complications arise when one tries to quantify the impact of the balance sheet shrinkage. Specifically, as the JPM quant notes, the questions investors struggle with are how negative was/will be the impact of the QT, to wit: "It is plausible that dollar for dollar, QT has a significantly larger impact than QE."

The reason for that, according to Kolanovic, has to do that may be the previously discussed fragility feedback loop. During QE, both central banks and investors, and certainly HFTs and algos, would broadly buy assets in an environment of low volatility/ increased liquidity when the impact is small, while during QT "assets are typically sold while liquidity is removed, compounding the negative impact of other outflows."

Others have also tried to quantify the impact of QT on risk assets, most recently Morgan Stanley, which last week calculated that every $20 billion decline in Mortgage Backed Securities held by the Fed leads to a 0.37% drop in the S&P (curiously, MS found that S&P 500 returns are not significantly correlated with changes in the Fed's Treasury holdings, although that observations will surely be retested soon).

lot more,,,,,,,,,,,,

http://www.zerohedge.com/news/2019-01-19/one-chart-every-trader-should-have-taped-their-screen

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.