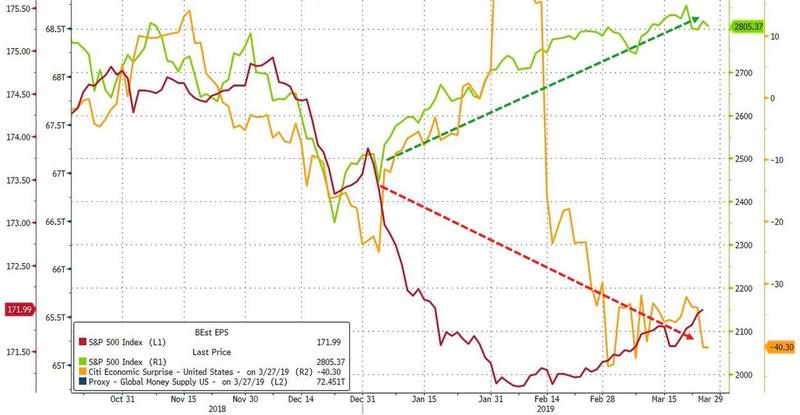

The US stock market has soared back from its December 'Mnuchin Massacre' lows, floating higher, blissfully ignoring the collapse in earnings expectations and macro-economic data.

The enabler of that blissful ignorance is simple - same as it has been for a decade - an ever-increasing hope that The Fed stands ready to do 'whatever it takes' to maintain the wealth (and inequality) driver of the new normal and the only policy prescription there is - the US stock market.

However, the market has seemingly got a little over its skis in recent weeks as it has priced in over 40bps of rate-cuts in 2019 - while The Fed just told the market to expect no rate-changes in 2019.

In fact, the market is now pricing in The Fed as being more dovish than The ECB in 2019...

more,,,,,,,,,,,,,,,

http://www.zerohedge.com/news/2019-03-27/mystery-trade-bets-huge-market-wrong-fed-rate-cuts

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.