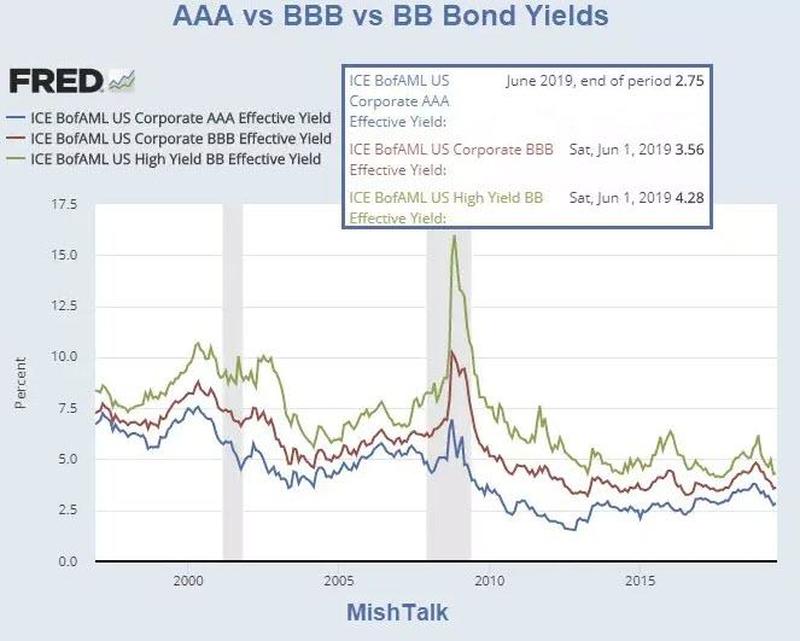

The highest grade AAA corporate bonds yield 2.75%. BBB-rated corporate bonds, just one step above junk, 3.5%. BB-rated bonds yield just 4.28%.

Corporate Bond Spreads

The spread between Prime AAA bonds and lower-medium grade bonds (see chart below) is just 0.77 percentage points.

The spread between BBB lower-medium grade bonds and non-investment grade, speculative BB-rated bonds is just 0.69 percentage points.

The spread between BBB and BB-rated bonds hit six percentage points in the great recession.

Bond Rating Steps

Volume of Negative-Yielding Debt Rises Sharply

In the real world, yields would never be negative. In the Central Banks' bubble-blowing world, the Volume of Negative-Yielding Debt Rises Sharply.

From a low last October of just under USD 6 trillions the value of the Bloomberg Barclays Global Aggregate Negative-Yielding Debt Index has more than doubled, increasing in value by over USD 7 trillions over the last 8 months to establish an all-time record of USD 13.2 trillions earlier in late June.

http://www.zerohedge.com/news/2019-07-19/junk-bond-bubble-pictures-deflation-next?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.