Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

âLenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.â

John Maynard Keynes â The Economic Consequences of Peace 1920

âAnd when we see that weâve reached that level weâll begin to gradually reduce our asset purchases to the level of the underlying trend growth of demand for our liabilities.â

âJerome Powell January 29, 2020.

With that one seemingly innocuous statement, Chairman Powell revealed an alarming admission about the supply of money and your wealth. The current state of monetary policy explains why so many people are falling behind and why wealth inequality is at levels last seen almost 100 years ago.

REALity

âRealâ is a very important concept in the field of economics. Real generally refers to an amount of something adjusted for the effects of inflation. This allows economists to measure true organic growth or decline.

Real is equally important for the rest of us. The size of our paycheck or bank account balance is meaningless without an understanding of what money can buy. For instance, an annual income of $25,000 in 1920 was about eight times the national average. Today that puts a family of four below the Federal Poverty Guideline. As your grandfather used to say, a dollar doesnât go as far as it used to.

Real wealth and real wage growth are important for assessing your economic standing and that of the nation.

Here are two facts:

Wealth is largely a function of the wages we earn

The wages we earn are predominately a function of the growth rate of the economy

These facts establish that the prosperity and wealth of all citizens in aggregate is meaningfully tied to economic growth or the output of a nation. It makes perfect sense.

Now, let us consider inflation and the role it plays in determining our real wages and real wealth.

If the rate of inflation is less than the rate of wage growth over time, then our real wages are rising and our wealth is increasing. Conversely, if inflation rises at a pace faster than wages, wealth declines despite a larger paycheck and more money in the bank.

With that understanding of âreal,â letâs discuss inflation.

What is Inflation?

Borrowing from an upcoming article, we describe inflation in the following way:

âOne of the most pernicious of these issues in our âmodern and sophisticatedâ intellectual age is that of inflation. Most people, when asked to define inflation, would say ârising pricesâ with no appreciation for the fact that price movements are an effect, not a cause. They are a symptom of monetary circumstances. Inflation defined is, in fact, a disequilibrium between the amount of currency entering an economic system relative to the productive output of that same system.â

The price of cars, cheeseburgers, movie tickets, and all the other goods and services we consume are chiefly based on supply and demand. Demand is a function of both our need and desire to own a good and, equally importantly, how much money we have. The amount of money we have in aggregate, known as money supply, is governed by the Federal Reserve. Therefore, the supply of money is a key component of demand and therefore a significant factor affecting prices.

With the linkage between the supply of money and inflation defined, let us revisit Powellâs recent revelation.

âAnd when we see that weâve reached that level weâll begin to gradually reduce our asset purchases to the level of the underlying trend growth of demand for our liabilities.â

In plain English, Powell states that the supply of money is based on the demand for money and not the economic growth rate. To clarify, one of the Fedâs largest liabilities currently are bank reserves. Banks are required to hold reserves for every loan they make. Therefore, they need reserves to create money to lend. Ergo, âdemand for our liabilities,â as Powell states, actually means bank demand for the seed funding to create money and make loans.

The relationship between money supply and the demand for money may, in fact, be aligned with economic growth. If so, then the supply of money should rise with the economy. This occurs when debt is predominately employed to facilitate productive investments.

The problem occurs when money is demanded for consumption or speculation. For example:

When hedge funds demand billions to leverage their trading activity

When Apple, which has over $200 billion in cash, borrows money to buy back their stock

When you borrow money to buy a car, the size of the economy increases but not permanently as you are not likely to buy another car tomorrow and the next day

Now ask, should the supply of money increase because of those instances?

The relationship between the demand for money and economic activity boils down to what percentage of the debt taken on is productive and helps the economy and the populace grow versus what percentage is for speculation and consumption.

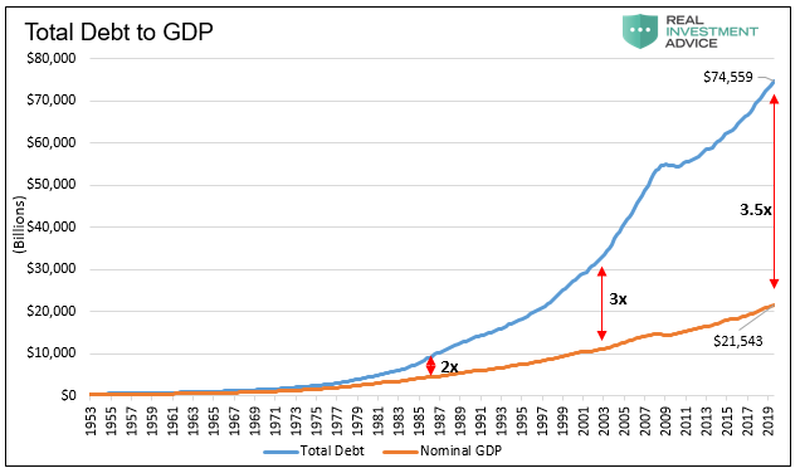

While there is no way to quantify how debt is used, we do know that speculative and consumptive debt has risen sharply and takes up a much larger percentage of all debt than in prior eras. The glaring evidence is the sharp rise of debt to GDP.

What could go wrong?????????????

LOT MORE,,,,,,,,,,,,,,,

http://www.zerohedge.com/markets/jerome-powell-feds-great-betrayal?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.