Via Global Macro Monitor,

More than his words, he spoke with his wallet. He usually relishes a down stock market to take advantage of lower prices. Not this time. He hadnât made any purchases recently; he didnât buy up stocks when they had fallen last month during what felt like a mini-panic: âWe have not done anything, because we donât see anything that attractive to do.â

â Warren Buffett, NY Times

Berkshire Hathaway held its annual âWoodstock for Capitalistsâ over the weekend. The event was conducted virtually because of the global pandemic where Buffett expressed a deep sense of concern about the immediate future.

Not Buying

Warren ainât buyinâ nuttinâ. In fact, he has just dumped all of his airline stocks.

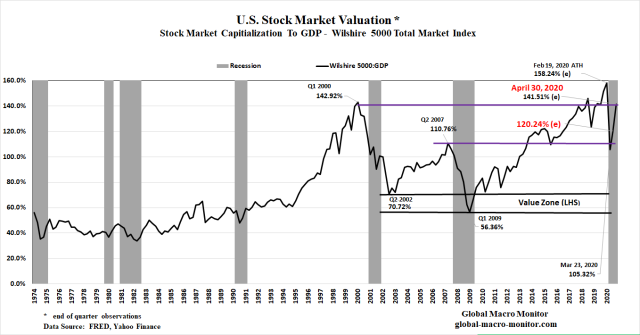

Take a look at the stock market cap-to-GDP ratio, aka the Buffett Indicator, and you will get of sense why Warren is stingy with his cash, which is mounting higher and higher to $137 billion by the day.

http://www.zerohedge.com/markets/uncharted-territory-are-you-really-buying-these-valuations?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

but also because risk cannot be priced (one reason to think a recent stockmarket rally has weak foundations).

LOL I dont think the fed pump is a foundation to base ones investing strategy's..... LMAOOOOOOOOOOO

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.