Authored by Egon von Greyerz via GoldSwitzerland.com,

As the Nasdaq makes a new high for the year, the world outside the stock market timebomb is falling apart. For example the UN agency, The International Labour Organisation (ILO) reports that 1.6 billion jobs are at risk in the global economy. That is half of the global workforce of 3.3 billion. Particularly vulnerable are the 2 billion people in the informal economy. For most of these vulnerable people, this means no income, no food and no security reports the ILO. This is a human tragedy on a massive scale and most people in the Western world are totally unaware.

HALF UK ADULTS PAID BY THE STATE

Looking at the UK, 23 million people which is half of all adults are now paid by the state. This includes people being furloughed, on unemployment benefits and public sector workers and pensioners. That is just an incredible proportion of the population which are getting free money for making no productive contribution. Yes, the human side is of course incredibly important and suffering people should be helped. The problem is only that THERE IS NO MONEY. What half of the adult population is receiving is money that doesnât exist but is just printed out of thin air and thus has no real value.

REAL US UNEMPLOYMENT 39%

If we take the US, Q2 GDP is forecast at -35%. Over 20 million have lost their jobs and both small and big businesses are going into a black hole. Most of these 20 million have no savings and couldnât survive for one month without government handouts. If we take the real US unemployment figure based on ShawdowStats, it is now 39%. If we compare that to the 25% unemployment during the depression in the 1930s, it is a staggering figure.

If the world, as I believe, has now entered a secular downturn of major proportions, many of these 20 million will never get their jobs back. That either means no income, no food, and nowhere to live or the government assisting these people permanently. Both of these outcomes will lead to perdition. No income means misery, disease and eventually a lot of people dying. Money printing is sadly no solution either. Once money is printed on a larger scale, the currency will be totally debased, become worthless with hyperinflation to follow. Just look at Venezuela with a major part of the population struggling to survive.

THERE IS NO SOLUTION

This is what is so sad with the current economic crisis â there is no solution. Nobody should believe that it is the Coronavirus that has caused this catastrophe for the world. CV was the catalyst but the underlying problems have been there for a long time. The Great Financial Crisis in 2006-9 was temporarily patched up with trillions of money printing but it was never solved. The GFC was only a rehearsal and now the world is facing the inevitable collapse of the financial system.

CENTRAL BANKS PANICKED IN AUTUMN OF 2019

That there was something rotten in the Kingdom of Denmark the World became crystal clear in the late summer and early autumn of 2019. The ECB then made it clear for a second time that they will do whatever it takes. And then the Fed started with daily and weekly Repos of $100s of millions. We have never been told the reason for these Central Banksâ panic actions but it is totally clear that the financial system is crumbling under the burden of massive debts and derivatives.

And then in February-March this year the most horrible catalyst in the form of a pandemic hit a fragile world economy at the worst possible moment. In my opinion, the world economy, lumbered with debts and deficits, would have crashed without the Coronavirus. But CV makes the problem much bigger and will cause the economic collapse to happen much faster.

What central banks around the world are doing will not make one iota difference when it comes to saving the world economy. You cannot solve a debt problem with more debt. The bankers have managed for some time to fool the world that creating money out of thin air can create wealth. But the world will very soon realise that it canât. Global debt has more than doubled since the last crisis started. It was $125 trillion in 2006 and now global debt is over $270 trillion. With the current money printing that figure will soon be over $300T and later increase by $100s of trillions.

MISPLACED IRRATIONAL EXUBERANCE

It is totally incomprehensible that stock market investors have for 7 weeks been buying the dip in the light of the world collapsing around them. They seem to be totally oblivious to the world economy. Instead they are just focusing on the injection of liquidity in the form of worthless money. These investors seem to believe that finance stands above everything else and is totally detached from what is happening in the real world.

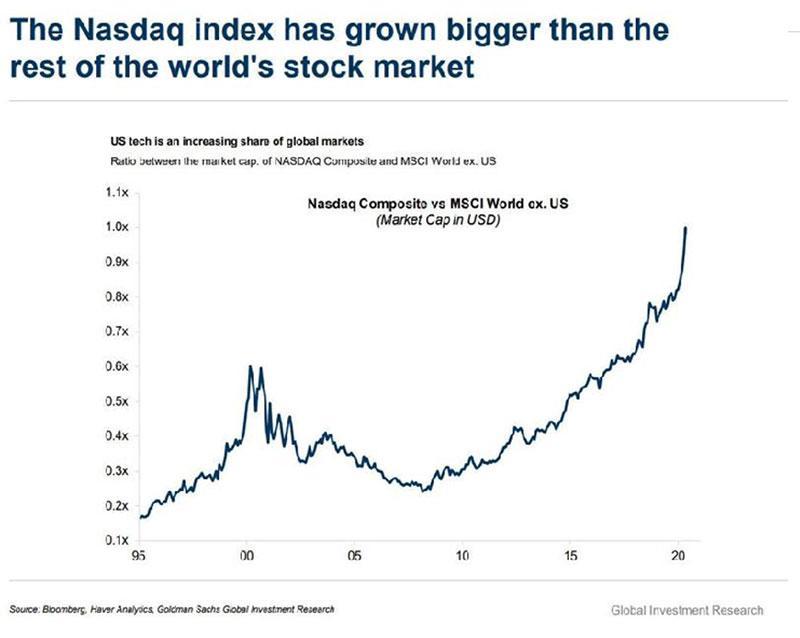

It seems that these investors believe there is only one important sector in the economy which is finance and money printing. The worse the economy turns, the more money is printed and stock market investors love it. This is why the Nasdaq Composite has just made a new high for the year. This is just unreal. The world economy is totally paralysed but who cares when you have money printers who can just create trillions out of thin air.

YUP.........

http://www.zerohedge.com/markets/von-greyerz-you-cant-avoid-final-collapse?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.