BWHA HA HA HA HA HA!!! Paul Krugman is just about the most buffoonish, consistently (and hilariously) wrong "economist" in the history of the world. The Swedish Marxists must have awarded him a Nobel Prize simply because Krugman's blatant foibles ARE. JUST. SO. DAMN. ENTERTAINING.

Paul Krugman says we should ignore the two-quarter rule defining a recession

http://twitchy.com/gregp-3534/2022/07/27/paul-krugman-says-we-should-ignore-the-two-quarter-rule-defining-a-recession/

And right on cue, New York Times columnist Paul Krugman says we should ignore the two-quarter rule that defines a recession:

Paul Krugman (@paulkrugman) ~ Ignore the two-quarter rule. We might have a recession, but we aren't in one now.

http://www.nytimes.com/2022/07/26/opinion/recession-gdp-economy-nber.html

âThAtâs NoT hOw rEcEssIons ArE dEfinEd,â he writes:

Thereâs a pretty good chance the Bureau of Economic Analysis, which produces the numbers on gross domestic product and other macroeconomic data, will declare on Thursday, preliminarily, that real G.D.P. shrank in the second quarter of 2022. Since it has already announced that real G.D.P. shrank in the first quarter, there will be a lot of breathless commentary to the effect that weâre officially in a recession.

But we wonât be. Thatâs not how recessions are defined; more important, itâs not how they should be defined. Itâs possible that the people who actually decide whether weâre in a recession â more about them in a minute â will eventually declare that a recession began in the United States in the first half of this year, although thatâs unlikely given other economic data. But they wonât base their decision solely on whether weâve had two successive quarters of falling real G.D.P.

Oh, that's not how it should be defined, eh, Paul? Well, it's been defined that way by everyone for decades and decades and decades, but in your desperation to carry water for Brandon, you want to redefine it whenever it is convenient to do so for Democrats. Yeah ... we got it, schmuck. By the way, how much did the White House pay you to write this oblivious, unscientific dreck? ROTFLMAO!

Does he ever get tired of being wrong?

He must not ... 'cuz Krugman is very rarely ever right about anything.

RNC Research (@RNCResearch) ~

Anyway, we expect the two-quarter rule would be interpreted just a tiny bit differently if say the bad orange man were still in the Oval Office:

Carol Roth (@caroljsroth) ~ If we had exactly the same data and circumstances, but Trump was still POTUS, do you think the media would be saying this?

Pure, undeniable situational ethics ... Democrats are inveterate liars, and liars are gonna lie.

This is their next rule, no doubt:

NeverTweet (@LOLNeverTweet) ~ Ignore the two-quarter rule. Abide by the can't-say-recession-one-quarter-before-election rule.

Itâs tiresome:

David Harsanyi (@davidharsanyi) ~ As with most things these days, there are two sets of rules.

http://thefederalist.com/2022/07/25/recession-no-problem-just-pretend-it-doesnt-exist/

Yep ... definition of "hypocrite" ~ see "Democrat."

And remember when the Dictionary used to dunk on takes like this? Good times, good times:

LaurieAnn (@mooshakins) ~

Whatâs funny about all this is the two-quarter rule provides a benchmark so people can compare different periods based on some sort of shared metric. What happens when the data does show weâre in a recession? Theyâll look even more foolish than they do now:

Paul Krugman (@paulkrugman) ~ It's a big data week, for those who care about these things. (The rest of you should ignore this thread.) GDP on Thursday, which may show a second quarter of negative growth. But I don't care much about this, bc 2q of negative growth does NOT mean a recession 1/

More about this in today's newsletter; but even aside from the 2-quarter rule being really bad, the main determinant of the economy's path forward will be how the Fed judges the inflation threat 2/

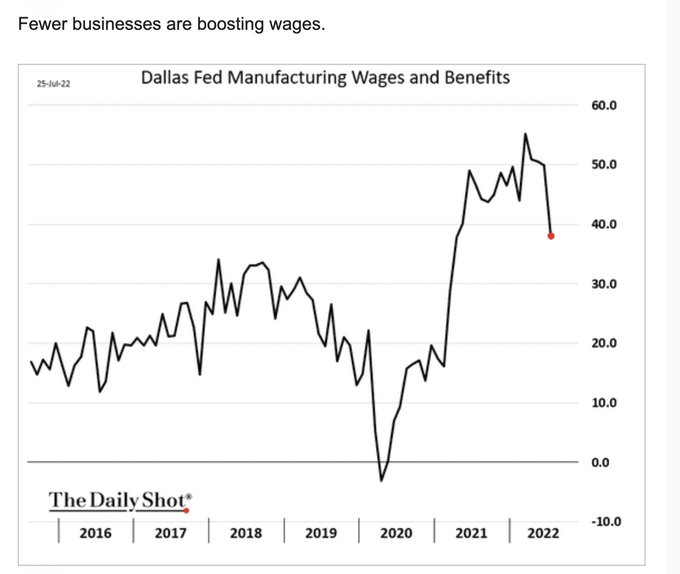

So Friday will be a bigger day with releases of the PCE deflator and employment cost index, especially the latter. Will it confirm average wage data suggesting a cooling labor market? 3/

Dallas Fed survey, just out, suggests that it might. via Daily Shot 4/

If so, we may be closer than people think to getting underlying inflation back on target. In which case the main recession risk will come not from intractable inflation but from Fed overshoot. 5/

Yep, Paul ... the Fed, as it is wont to do, could very well overshoot with interest rate hikes to combat inflation and cause a deeper recession. But, dumbass ... your boy Brandon very much helped cause this inflation in the first place with his outright WAR against our domestic oil and gas industry and his pathetic ineptitude in reacting to supply chain problems. Brandon is a lying f*ck up, Paul ... and so are you.