http://dailycaller.com/2024/03/18/huge-discrepancy-jobs-data-bidens-economy-stronger-paper/

By Will Kessler

The Daily Caller

March 18, 2024

* Data from the Federal Reserve Bank of Philadelphia estimates that the U.S. economy added more than two-thirds fewer jobs in the third quarter than the Bureau of Labor Statistics (BLS) has reported.

* Poor economic conditions have led to a rise in part-time positions and layoffs that have made it difficult to accurately track current employment estimates, leading to huge, consistent downward revisions, economists told the Daily Caller News Foundation.

* âAt this point, thereâs no denying that something is seriously wrong with the methodology at the BLS,â E.J. Antoni, a research fellow at the Heritage Foundationâs Grover M. Hermann Center for the Federal Budget, told the DCNF. âThe question is, why havenât they fixed it? Today feels eerily reminiscent of 2008 when the economy was quickly deteriorating and the BLSâ methods were consistently overestimating the number of jobs in the economy month after month.â

Data from the Federal Reserve Bank of Philadelphia estimates that the U.S. economy has added far fewer jobs than estimates the Bureau of Labor Statistics (BLS) have reported, leading economists to believe the economy is not nearly as strong as the numbers would make it seem.

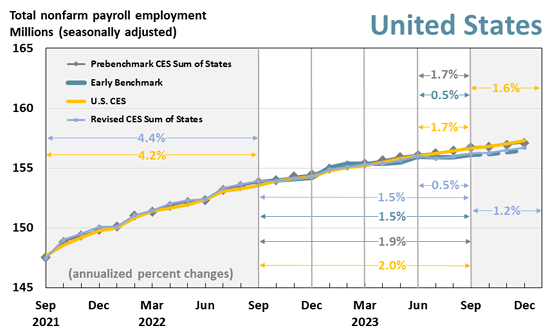

For the third quarter of 2023, the Philadelphia Fed now estimates that the number of total workers in the U.S. economy increased from 155,941,000 to 156,127,000, a gain of just 186,000, while the BLS estimates that the employment count rose from 156,027,000 to 156,667,000, an increase of 640,000. The lower estimates from the Philadelphia Fed indicate that the economy is not doing nearly as well as initial government figures have advertised, with poor underlying economic conditions making the data hard to accurately calculate initial projections, resulting in huge overestimations by the BLS, economists told the Daily Caller News Foundation.

âThe Federal Reserve Bank of Philadelphiaâs advance estimates have been much closer to the quarterly census data, which covers more than 95% of jobs and is more accurate than the monthly job reports,â E.J. Antoni, a research fellow at the Heritage Foundationâs Grover M. Hermann Center for the Federal Budget, told the Daily Caller News Foundation. âThis points to the economy being weaker than many of the official data would suggest and helps explain the disparity between low approval of the economy in polls and the positive official data. It also points to weaker future economic growth.â

Consumer sentiment, a measurement of how consumers feel about the economy, has continued to be depressed below pre-COVID-19 pandemic levels, where it typically measured between 90 and 100 index points, but has since remained lower, most recently rising to just 79 points, according to a survey by the University of Michigan. If Americans are correct about the perceived poor health of the economy, it would contradict seemingly strong economic growth in the second half of the last year, with gross domestic product rising 3.2% and 4.9% in the third and fourth quarters of 2023, respectively, according to the Bureau of Economic Analysis.

âAt this point, thereâs no denying that something is seriously wrong with the methodology at the BLS,â Antoni told the DCNF. âThe question is, why havenât they fixed it? Today feels eerily reminiscent of 2008 when the economy was quickly deteriorating and the BLSâ methods were consistently overestimating the number of jobs in the economy month after month. Revisions, even occasionally large ones, are normal, but the problem is that the revisions are so consistently in the same direction. It would be foolish to take these monthly job numbers at face value.â

The Philadelphia Fed, which has generated accurate results in the past, produces its own estimations of job data in an attempt to predict upcoming revisions to the BLS numbers. In 2023, the BLS overestimated the number of jobs in the U.S. economy by an average of 105,000 per month, with there being 1,225,000 less than previously thought by the end of the year.

In the midst of the Great Recession in 2008, the BLS revised its jobs numbers down for 11 months out of that year, according to the BLS. In total, final numbers were revised down by 877,000 compared to initial estimates, an average of around 73,000 per month.

âWhen economies slow, individuals may be less likely to respond to surveys due to social desirability bias, as feelings of shame or stigma associated with unemployment may deter participation,â Peter Earle, an economist at the American Institute for Economic Research, told the DCNF. âA factor known as âtime povertyâ may also be a factor, as individuals either out of work or worried about losing their jobs prioritize job searches or taking on more hours, leaving them with limited time to participate in surveys.â

E.J. Antoni, Ph.D. (@RealEJAntoni) ~ So, this seems like a big deal ... BLS said jobs grew 640k in Q3 '23, but PHL Fed now estimates it was only 187k, or less than a third of the BLS estimate; this comes on the heels on the quarterly survey estimate for Q2 '23 coming in half the size of BLS's monthly jobs numbers:

Layoffs at U.S. companies have surged in recent months as businesses look to adjust their headcounts to account for market conditions. In January, layoffs spiked 136% month-to-month to 82,307 positions, followed by a 3% climb in February on top of that.

The BLS estimated that the U.S. added 275,000 nonfarm payroll jobs in February, far higher than expectations of 200,000, while unemployment ticked up from 3.7% to 3.9%. Despite the large gains, the totals from the previous two months were revised down by a cumulative 124,000 jobs.

The U.S. has also so far failed to conquer high inflation, which has remained elevated since it peaked at 9.1% in June 2022, most recently coming in at 3.2% year-over-year in February. In response to high inflation, the Federal Reserve has placed its federal funds rate in a range of 5.25% and 5.50%, putting upward pressure on interest rates and raising the cost of credit across the economy.

âThe establishment survey, which is responsible for generating nonfarm payroll figures, is also prone to double-counting individuals holding multiple jobs,â Earle told the DCNF. âThis issue becomes particularly pronounced early in and throughout economic downturns when employers reduce workersâ hours. As more individuals seek additional employment opportunities, what is actually economic distress may appear to be growth in employment.â

The number of full-time jobs has plummeted by more than 1.8 million since June 2023, as of February, while part-time positions soared by nearly 1.7 million as Americans are forced to take up multiple jobs to make ends meet. Americans with multiple jobs jumped by 376,000 in February year-over-year.

The BLS pointed the DCNF to downward revisions it had already made in early March of 266,000 fewer jobs when asked about the discrepancy.

âThe BLS periodically makes major revisions to their datasets, sometimes going back years, and I suspect they will take one of those opportunities to correct some of their errors on the job numbers, but sometimes these mistakes are never officially corrected,â Antoni told the DCNF.

The essential American soul is hard, isolate, stoic, and a killer. It has never yet melted. ~ D.H. Lawrence