NYC Home Prices Are Headed for Collapse

June 3, 2011

by Keith Jurow

SeekingAlpha.com

New York City is the largest city in the U.S. with roughly eight million residents. The metro area encompasses 18 million people. What occurs there has national ramifications. Now is a good time to take a look at why the entire New York City market is headed for collapse.

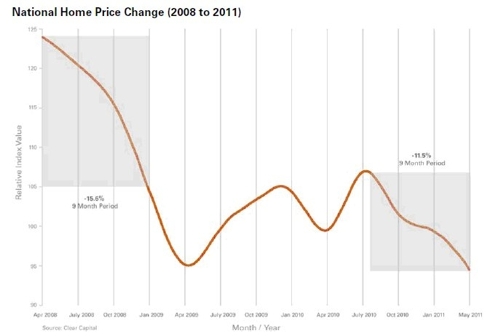

First, let's see what's happened to home prices around the country since the expiration of the first-time buyer tax credit. The best source for this is Clear Capital and its excellent Home Data Index (HDI) Market Report.

Since the end of last summer home prices nationwide have plunged by an average of 11.5% through April 2011. Some of the worst major metros have fallen even more. Talk of home prices bottoming has stopped. For a year, I've been saying that there is no housing recovery in sight.

Yet New York City median home prices have held up pretty well during this period. Why?

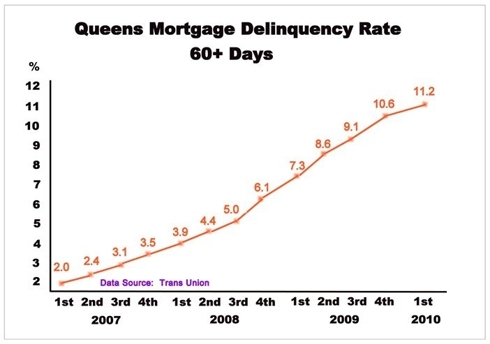

Most Seeking Alpha readers are not aware that the servicing banks are simply not foreclosing on delinquent homeowners. They aren't even putting them into default. Take a look at this chart showing the rise in serious delinquencies in Queens:

.

.

.

When the banks begin to foreclose and dump the REOs on the market, prices in all five boroughs will completely collapse. This is almost as certain as night follows day. Ignore it at your own risk.

Full story: http://seekingalpha.com/article/273162-new-york-city-home-prices-are-headed-for-collapse

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months