March 16, 2017

Most Overvalued Stock Market On Record â Worse Than 1929?

By Mark O'Byrne

GoldCore

The US stock market today has never been more dangerous and overvalued, according to respected Wall Street market analyst John Hussman.

Indeed, Hussman goes as far as to say that âthis is the most dangerous and overvalued stock market on record â worse than 2007, worse than 2000, even worse than 1929â as reported by Marketwatch.

For some months now, Hussman of Hussman Fundsâ has been warning in his research that investors are ignoring extremely high stock market valuations and are being lulled into a false sense of security by central bank liquidity, massive quantitative easing and zero percent and negative interest rates.

Hussman begins his latest research note by quoting the late, great Sir John Templeton:

âBull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.â

He then warns

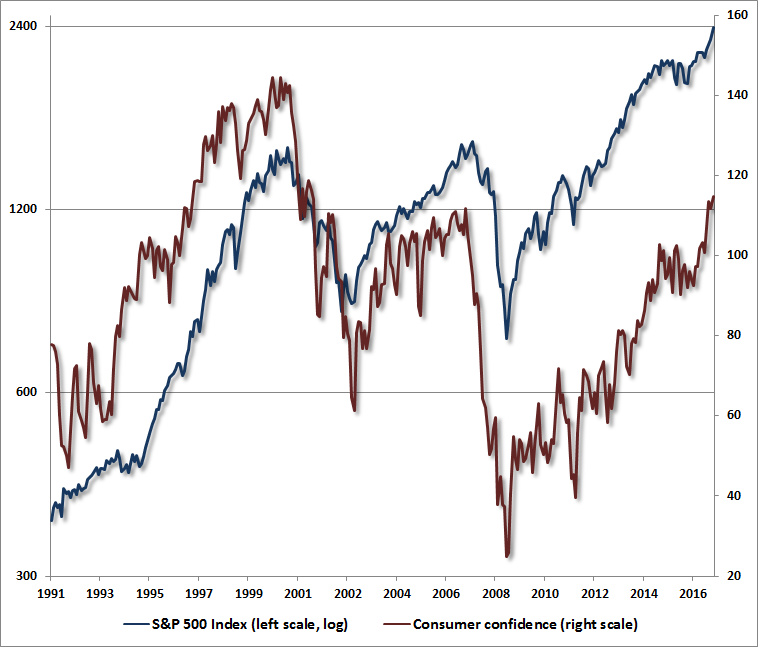

âA week ago, bullish sentiment among investment advisers soared to the highest level in 30 years (Investorâs Intelligence), joined last week by a 16-year high in consumer confidence. When one recognizes that the prior peak in bullish sentiment corresponds to the 1987 market extreme, and the prior peak in consumer confidence corresponds to the 2000 bubble, Sir Templetonâs words take on both relevance and urgency.â

Hussman advises investors become more defensive because the market could be about to enter a brutal bear market as seen throughout history.

Huge crowds gather in shock at the New York Stock Exchange after 1929 stock-market crash.

Hussman Funds provide in-depth analytical research on the US stock market. They use long-term valuation models, reversion to the mean and mathematics to support their views.

Dr. Hussman says what weâre currently seeing is worse than 2007 when the global financial crisis brought the world economy to its knees, worse than 2000 when the tech bubble popped and caused a market catastrophe, and even worse than the biblical Wall Street 1929 crash.

The Dow Jones Industrial Average recently breached the hugely important psychological level of 20,000 and has recently surged over 20,100 to 21,115.

Throughout history, the first breach of these important psychological resistance levels is usually the end of â rather than the beginning of â a stock market boom. After the initial breach of the barrier, it takes years for the market to make a permanent breach through these âbarriersâ (see below).

The server hosting this article seems to have crashed while I was bringing it across. Oh well. I think this was most of the article.

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months